Renters Insurance in and around West Richland

Your renters insurance search is over, West Richland

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through deductibles and savings options on top of managing your side business, work and family events, can be overwhelming. But your belongings in your rented home may need the incredible coverage that State Farm provides. So when trouble knocks on your door, your sports equipment, pictures and clothing have protection.

Your renters insurance search is over, West Richland

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

You may be questioning if Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. What it would cost to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

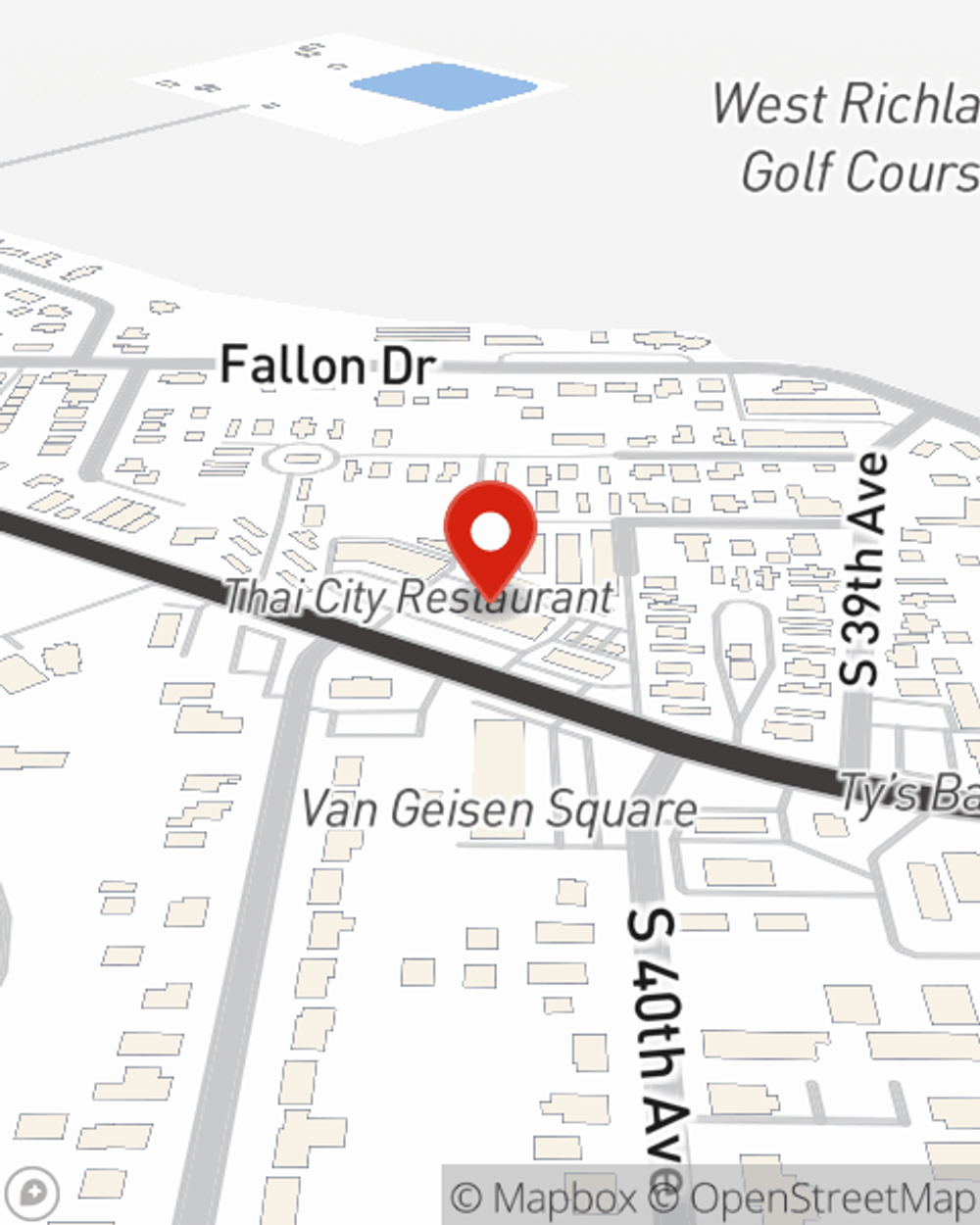

If you're looking for a reliable provider that offers a free quote on a renters policy, call or email State Farm agent Susan Dahl today.

Have More Questions About Renters Insurance?

Call Susan at (509) 578-1111 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.